Three Years Success Giving Families Independence - FEP Cumulative Report

Migrant families don’t have access to the regular banking services that most of us take for granted. They don’t have a secure way to save their money. There is no safe place to keep it. Homes are not secure. Many don’t even have doors that lock. Your belongings are only as safe as your neighbors are trustworthy. Often women buy gold jewelry with any extra money, and sell it when they need cash. But even this can be stolen, and the return value isn’t guaranteed.

When a migrant family has an emergency and needs to borrow money they can either go to their neighbors, or extended family, or go to a loan shark. If there is an emergency and a large amount is needed the loan shark is the only option. The interest rate they charge is up to 20%/month until the loan is repaid in full. Families can end up paying back double the amount they borrowed in interest payments.

[A baby takes center stage at a family financial management training.]

In 2017 we launched our Family Enterprise Program to address these and other problems.

With access to secure savings services, reasonable loans, financial management coaching, and savings coaching, families consistently move from a day to day, hand to mouth, survival mentality to saving for and investing in their family’s financial future.

Family Enterprise consists of several parts.

Household financial management training and an introduction to VSLA

This training helps many people learn for the first time that even if they don’t make a lot of money they can save. Changing small habits can allow them to save more money. Before they attend this training many people tell us that they never realized the cumulative cost of small expenditures, or how a small savings can add up over time. For example; many people pay 10-20baht($0.30-$0.60USD)/day for betel nut, a mild stimulant that they chew that gives energy and suppresses hunger. The trainer explains that if they just chew less betel nut each day in ten days they could save 100-200baht (Almost a full day’s wages). For many, they have never done the math on this habit, to see what it costs them over the long run.

Village Savings and Loan Associations

We train communities to manage and administer their own micro savings and loan association. This globally validated model brings the community together to save together and to empower each other. Members save through purchasing shares at each meeting. Members can also borrow from the group, and the service fees they pay on the loan go back into the group savings and becomes the profit their money earns, on top of the savings they collect at the end of each 10 month saving cycle.

Since 2017 we have launched 34 savings groups with 497 members total. On average, each member represents one household of 5 people.

The total amount saved by the groups since we began this project including the money currently under management is 1,538,950 Thai baht($50,491USD).

The total amount borrowed and paid back is 1,565,050 baht($49,649USD).

The total profits earned through service fees is 407,782 baht($13,156USD).

The total amount that has already been paid out to members including both savings and profits (not including money currently under management) is 1,458,515 baht($47,054USD).

Vocational training

- Basic Business Cycle Training

Where possible FEP has offered vocational training to help families gain the skills to get better jobs, or start their own business.

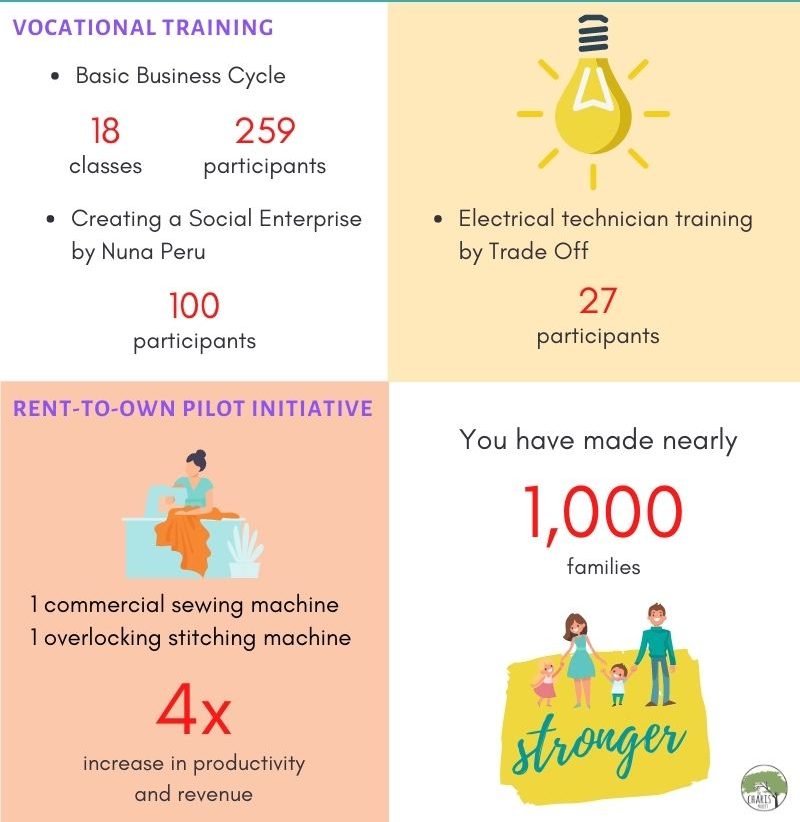

Since 2017 we have held 18 Basic Business Cycle Training classes with 259 participants, representing about the same number of families.

In 2018 FEP collaborated with Nuna Peru to provide training to 100 people on how to create social enterprises.

In 2018, 2019, and 2020 FEP collaborated with Trade Off to provide electrical technician training to a total of 27 students. These classes began at a beginner level and students progressed to more advanced levels of training over subsequent years.

- Rent to Own

In the Rent-to-Own pilot project, the qualified applicant (someone with a good savings group record, and references from their VSLA community) chooses the equipment they want at the cost they are willing to pay, from the store they prefer. They give us this information and our foundation will purchase the equipment and deliver it to them. After that they pay us a monthly rental fee that accrues until they have paid 110% of the purchase cost, at which point they become the sole owner of the equipment. The extra 10% fee pays our administration cost.

So far our rent to own initiative has helped with the purchase of one commercial sewing machine, and one over lock stitching machine . These capital investments, made possible by the FEP Rent-to-Own program, have increased the productivity and revenue of these small businesses by 400%. [Daw Aye Min Turned Her Dreams to Reality]

So far your support for the Family Enterprise Program has enabled nearly 1000 families to have access to financial management training, secure savings structures and affordable loans, vocational training, and the ability to rent to own equipment for their business, all of which works toward strengthening the whole community. Thanks to you, these families no longer have to worry about the future, and what they will do when a crisis hits. They have savings. They have resources. They can start a business, or buy land, or send their children to school. They have a community structure that will help them through a crisis. Through supporting Family Enterprise you are making families stronger.

Carrien is co-founder of The Charis Project, Family Education Curriculum Developer, and mom of 6.

You can get her free mini-course on Making Your Family More Resilient here.